AR Metrics & KPIs

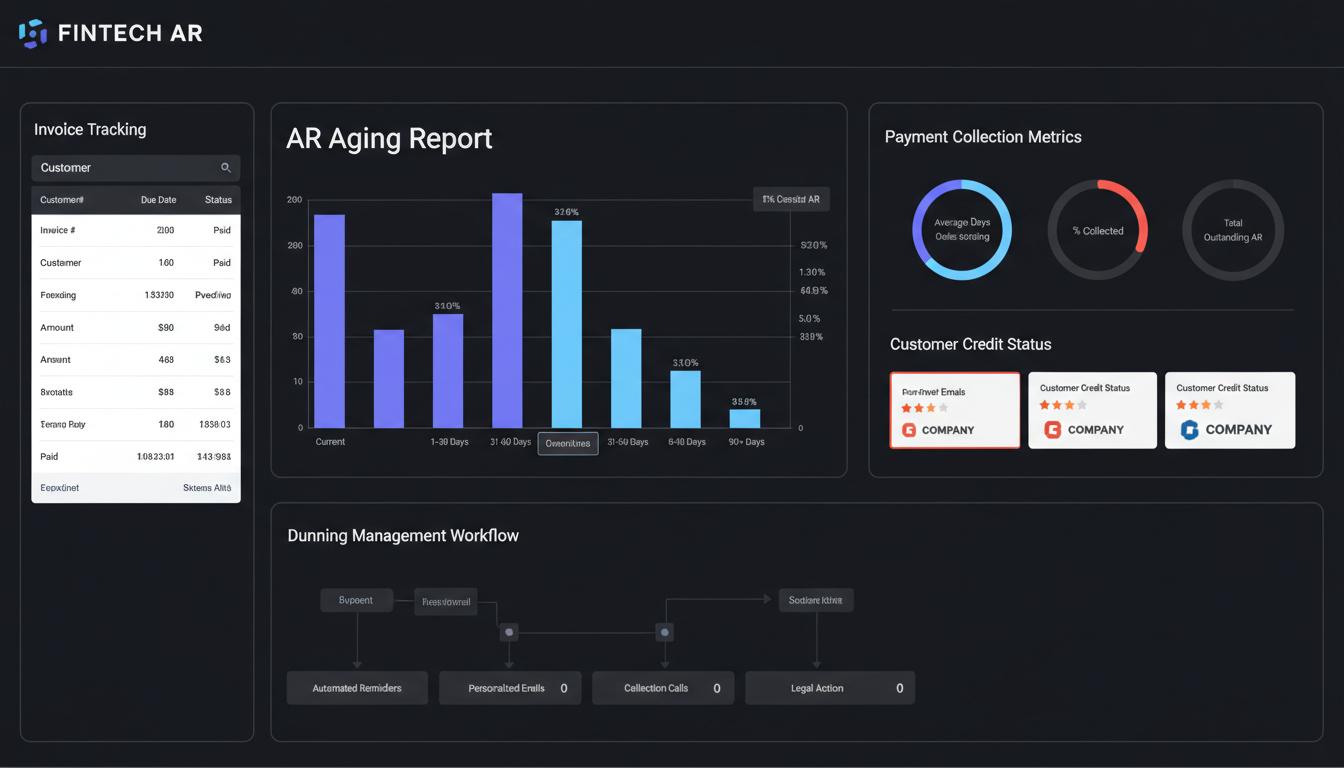

DSO (Days Sales Outstanding) measures average collection time. Best practice DSO is within 10 days of payment terms. CEI (Collection Effectiveness Index) targets above 80%. Bad debt ratio should remain below 0.5% of sales. AR turnover indicates how often receivables are collected annually. Aging reports track invoice distribution by age buckets.

Credit Risk Assessment

5 C's of Credit: Character, Capacity, Capital, Collateral, Conditions. Financial statement analysis evaluates liquidity, profitability, and leverage. Trade references provide payment history from other suppliers. Credit bureau scores predict default probability. Industry benchmarks compare customer performance to peers. Ongoing monitoring detects deterioration signals.

Collections Best Practices

Contact customers before invoices are due to confirm receipt. Use multiple communication channels: email, phone, portal notifications. Personalize dunning messages based on customer relationship and history. Offer convenient payment options and early payment discounts. Document all promises to pay and follow up on missed commitments. Escalate systematically based on age and amount.

Technology in AR

ERP integration ensures real-time invoice and payment visibility. Customer portals reduce inquiry calls and improve satisfaction. Automated workflows route tasks based on rules and workload. AI predicts payment timing and identifies at-risk accounts. E-invoicing accelerates delivery and reduces disputes. Payment gateways enable online payments and auto-pay options.