Payment Methods & Characteristics

Checks remain common in B2B but are declining. ACH offers lower cost and faster clearing. Wires are used for high-value and international payments. Virtual cards provide enhanced security and rebate opportunities. Each method has different remittance data availability and processing requirements.

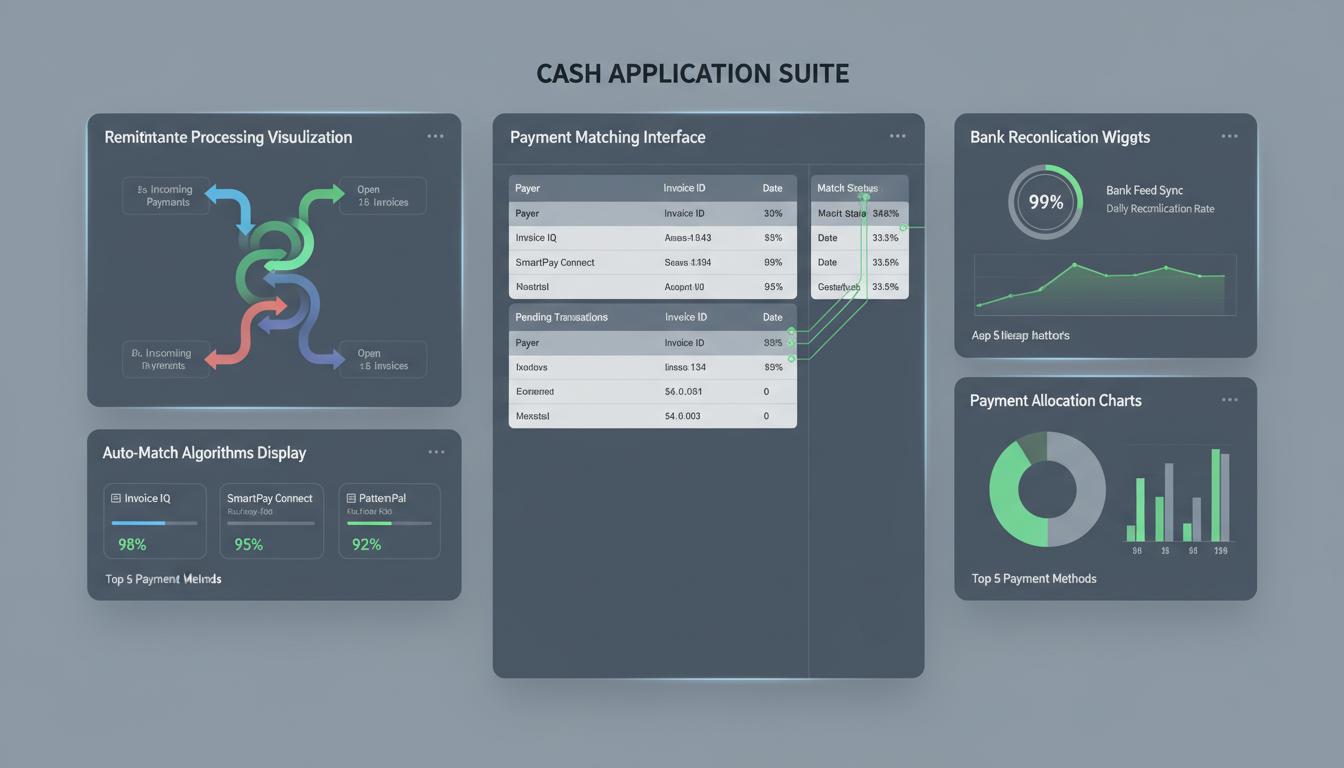

Matching Algorithms & Logic

Exact matching requires invoice number and amount to match perfectly. Fuzzy matching handles variations in invoice numbers and small amount differences. Partial payment matching applies payments across multiple invoices. Predictive matching uses customer history to suggest matches for unclear items.

Remittance Data Formats

EDI 820 is the standard electronic remittance format. Email remittances require OCR extraction and validation. Vendor portals may require web scraping or API integration. Paper remittances need scanning and data extraction. Each format requires different processing approaches and validation rules.

Cash Application Metrics

Auto-match rate should exceed 90% for mature operations. Average processing time per payment should be under 2 minutes. Unapplied cash should remain below 1% of total receipts. Exception resolution time should average under 24 hours. Same-day posting rate should exceed 95%.